Wealth Managers and Advisors for High-Net Worth Clients

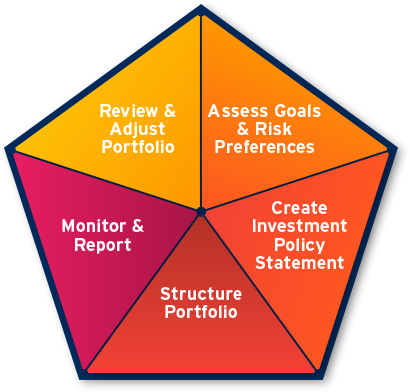

Patton Albertson & Miller is an independent, fee only, financial life management firm serving affluent individuals and families throughout the United States. We provide solutions to just about any financial management issue you may face, from managing daily finances and investments to a broad range of long-term planning strategies for you and your family. We provide these solutions by collaborating with other members of your professional team – resulting in a plan that is well-thought-out, customized, and comprehensive. Whether you simply need investment guidance or want a quarterback to steer a team of financial and legal advisors toward common goals, we’re here to help you with our comprehensive roster of financial services.

With offices in Georgia and Tennessee, Patton Albertson & Miller serves clients throughout the U.S. No matter where you live, we're available to serve your wealth management needs. Call us today at 866-606-5554 to learn more.